The answer to this question should be binary: yes or no? A positive answer would be translated mathematically by freemium feature costs lower than direct acquisition costs.

Table of Contents

STEP 1: Calculate the present value of your freemium feature costs

Your freemium feature will generally imply several categories of costs.

- Initial development costs: as a lump sum, no discounting is necessary. You should just be careful to not underestimate them.

- Annual maintenance costs: you consider that the freemium business model is scalable with no marginal costs. The annual maintenance cost is generally based on proportion of your FTE that you affect to the freemium feature. For example, a $400K annual maintenance cost corresponds to 2 FTE at an annual cost of $200K. The net present value of the recurring annual maintenance costs can deducted by multiplying the annual maintenance cost by a multiplier. Considering a startup mortality table, we advise you to use a multiplier of 3 times the annual maintenance cost.

- Freemium user acquisition costs: even if you give a feature for free, you could need to create awareness around your offer. For each paying customer, the Customer Acquisition Cost (CAC) is equal to the CAC of a freemium user divided by the conversion rate to the paying feature.

Where C(t) is the traction or the number of paying customers at the date t.

STEP 2: Calculate the present value of direct acquisition costs

This step requires to have an estimate of the Customer Acquisition Costs in case of direct acquisition:

The number of customers to acquire or the gross variation of paying customers is equal to the net variation of paying customers (the derivative) plus churned customers.

And a beautiful paradox appears: “Your free choice stops where the consequences of your choice come to light”.

STEP 3: Deduct how much you can spend on your freemium feature

The direct acquisition costs determines the maximum you can spend on your Freemium feature:

By deducting the Customer Acquisition Costs of the freemium users from the Customer Acquisition Costs of a direct acquisition strategy, we get the equivalent of a net saving on the right side of the inequality:

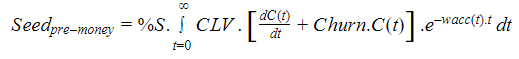

As we know from a Customer Based Valuation (%S the percentage of survival) that:

We can avoid a dangerous hypothesis on the traction of the paying feature:

The right term numerator is replaced by a percentage of savings on the direct Customer Acquisition Cost:

And, as a precaution, the Customer Lifetime Value (CLV) is set around the direct CAC (high range):

The constraint becomes:

By transferring the survival rate and the seed pre-money valuation on the left, we obtain the general constraint for a profitable freemium business model:

Conclusion

The Net Present Value of the freemium feature costs divided by the seed pre-money valuation “without failure” should be lower than the percentage of savings on the CAC of a direct acquisition strategy.